Cytiva and Longitude (a Financial Times company) reveal five major challenges for the industry in new Global Biopharma Resilience Index

- A survey of 1,165 biopharma executives and healthcare policymakers across 20 countries measured ability of industry to respond to global needs in five areas: Supply chain resilience, talent pool, R&D ecosystem, manufacturing agility, and government policy and regulation

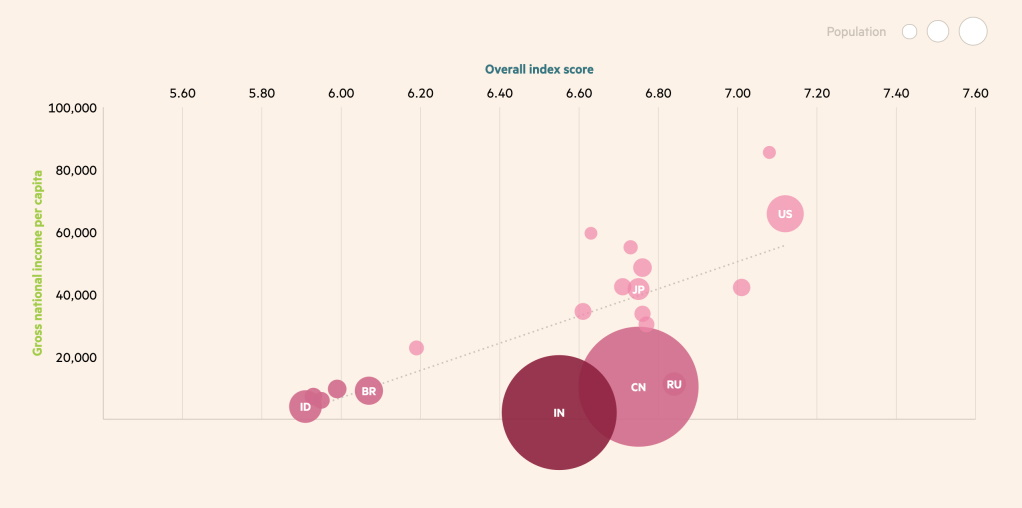

- There is a strong correlation between higher performing countries and higher income per capita; United States leads the index overall but Switzerland and China have most resilient supply chains

- First such study to cover wide range of topics and respondents

March 9, 2021

Global life sciences leader Cytiva, along with the Financial Times’ research arm Longitude, have compiled a global index, ranking the ability of the biopharma industry to respond to five major challenges; in supply chain, talent, research and development, manufacturing, and government policy and regulation.

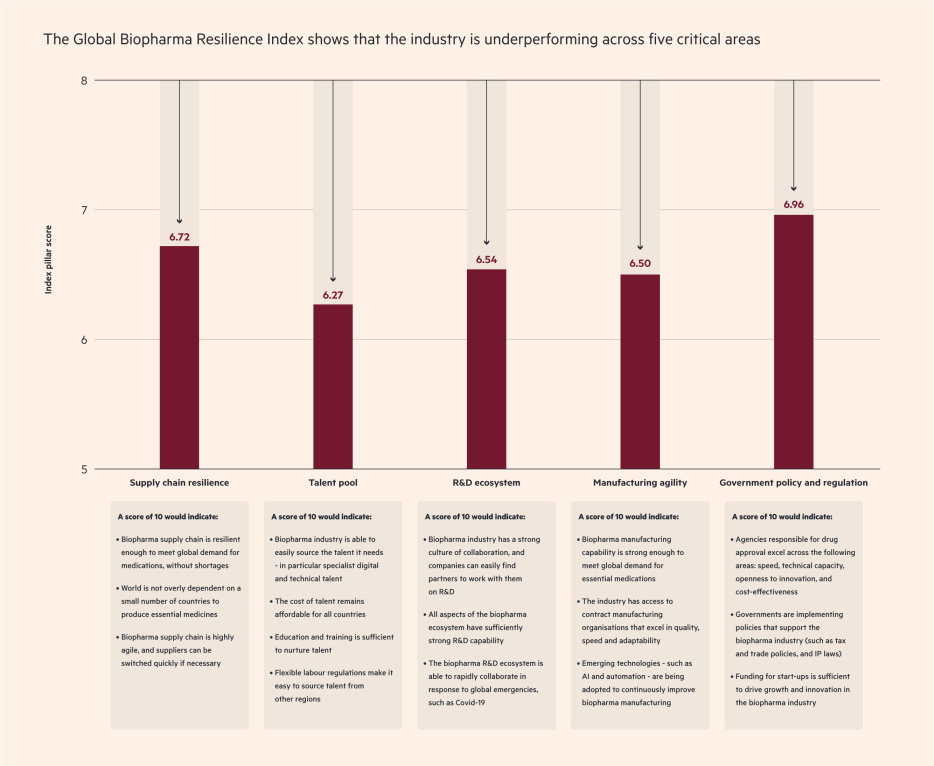

Respondents answered questions on a scale of 1 to 10 in each of the five areas. The average of all responses resulted in the rating of each country’s biopharma capabilities as well as the strength of the global industry. With an overall index score of 6.6 out of 10, the industry looks vulnerable – and has scope to improve across a number of critical areas. In the overall index, the United States ranks first, with a 7.12 score. Switzerland and the UK follow closely.

Russia, China and India are leading in the lower-middle income and upper-middle-income economy countries1, despite having large populations and lower GNI per capita than some of the other countries in this group. However, the index also highlights a clear divide between high-income vs upper-middle-income and lower-middle-income economies. The upper-middle-income and lower-middle-income economies tend to score lower on the index: this indicates that they have less resilient biopharma industries, which creates a significant risk in terms of global access to vital medications.

Emmanuel Ligner, President and CEO, Cytiva, says: “As a partner to global biopharma companies, we wanted to offer this overview of where the industry is performing well, and where there are some pain points. The data is built by listening to customers and key players, and gives us insight into major concerns. With this data, we’ll have even more fruitful conversations and be better prepared to work with customers and stakeholders to address industry-wide challenges.”

Kiran Mazumdar-Shaw, founder and chairperson of Biocon, says: “Biopharma has a huge role to play in the future of medicine, and many of the medicines that we are developing now will be game-changing. But developing blockbuster drugs shouldn’t be about making a billion dollars – it should be about serving a billion patients. That’s when we will have global equity in healthcare.”

Bubble chart: Index scores by Gross National Income per capita.

Bar chart with pillar scores: how far the industry is from best practice in each of the pillars, and summarises what a score of 10 would mean for biopharma.

The index was built from 1,165 survey respondents across 20 countries (95% pharma and biopharma executives and 5% healthcare policymakers), in addition to in-depth interviews with eight experts from biopharma and healthcare policymaking.

Hannah Freegard, Managing Editor at Longitude, a Financial Times company, said: “2020 revealed some uncomfortable truths about a sector that has become a globalized system of production, trade and distribution.”

In-depth look into the five areas

- Supply Chain resilience: 47% of executives say that their country is moderately or highly dependent on the import of drugs. Shortages tend to be more common in countries with a lower GNI per capita, and COVID-19 has exacerbated existing issues around drug insecurity.

- Talent pool: Sourcing talent is a major challenge – compounded by rising costs and inflexible labor regulations. More than half of executives say that the cost of digital, manufacturing and R&D talent has increased in their country in recent years.

- R&D ecosystem: Nearly half of executives believe that both traditional pharma and biopharma firms have a widespread culture of cooperation and open innovation with other sectors (44% for each); however, this drops significantly when looking from the perspective of academic institutions (32%) and government think tanks (27%), among others. This suggests that some areas of the industry lack a culture of open innovation.

- Manufacturing agility: Domestic pharma firms are not ready to fully meet the needs of their own populations. If required, on average countries would be able to fulfill about 75% of the domestic need for insulin and vaccines, but this drops to about 58% for biologics.

- Government policy and regulation: Governments are pursuing policies that support domestic pharma manufacturing, but they must go further to improve funding for start-ups and intellectual property rights.

Visit this site for the full report, including graphics and in-depth results.

1Using the World Bank country classifications, based on gross national income per capita

About Cytiva

Cytiva is a global life sciences leader with more than 7,000 associates across 40 countries dedicated to advancing and accelerating therapeutics. As a trusted partner to customers that range in scale and scope, Cytiva brings speed, efficiency and capacity to research and manufacturing workflows, enabling the development, manufacture and delivery of transformative medicines to patients.

Media Contact:

US/Europe

Colleen Connolly

[email protected]

Asia Pacific

Iris Zhao

[email protected]