Camilla Lindgren, Security of supply program leader, Cytiva Mike Toner, Global product manager, Cytiva and Fredrik Lundström, Global product manager, Cytiva

The use of single-use technologies has been growing steadily over the past decade and approximately 85 percent of all pre-commercial biomanufacturing is already being conducted using single-use (1).

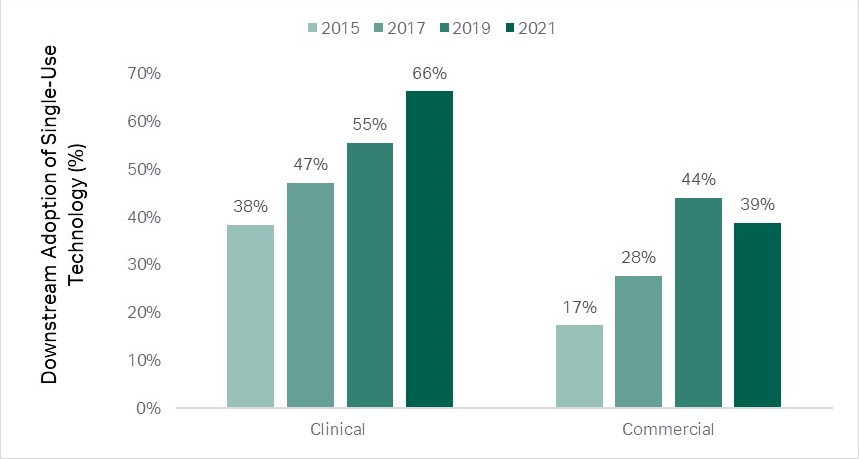

Upstream operations have been leading the trend, but downstream is catching up. In downstream clinical manufacturing the use of single-use technologies has increased from 38 percent in 2015 to 66 percent in 2021, and in commercial manufacturing from 17 percent in 2015 to 38 percent in 2021 (2).

Emerging therapy developers, such as cell and gene therapy and vaccine adjuvants obtain great benefits with single-use technologies and have no desire to use stainless-steel equipment, boosting the uptake even further (1).

Fig 1. Upstream operations have been leading the single-use trend, but downstream is catching up.(2)

It is not always easy when it comes to implementing single-use technologies. Weibing Ding, director of GSK Pharma in King of Prussia, Pennsylvania highlighted in an interview with BPI that COVID-19 has further increased the already soaring demand for single-use technologies and “supply constraint has become the top constraint for the industry.”

Before diving into current challenges and potential solutions, let’s first look at why single-use technology is growing so quickly.

Why has the use of single-use technologies increased so rapidly?

Increased focus on capital expenses (CAPEX)

The tremendous titer increases for monoclonal antibodies (mAbs) paired with the global financial crisis has forced biopharma companies to take a hard look at their CAPEX investments. The degree of manufacturing facility utilization has become increasingly important, where it is now considered undesirable to have large facilities standing still between manufacturing runs.

Process intensification

Single-use technologies aid higher efficiency and turn-around time by eliminating cleaning-in-place (CIP) and sanitization-in-place (SIP). A study shows that a ten-fold reduction in system set-up time can be achieved in downstream bioprocessing with single-use flow paths and prepacked columns (3).

Fig 2. Single-use technologies are increasingly popular due to the increased focus on CAPEX, process intensification requirements, cross-contamination challenges, and ongoing titer changes.

Prevention of cross-contamination

Single-use technologies reduce complexity and shorten lead times in upstream processes. They also improve the ability to prevent cross-contamination in downstream processes, particularly for processes handling potent or toxic material, such as viral vectors and antibody drug conjugates (ADCs). More stringent regulatory requirements also endorse the adoption of single-use technologies.

Process and titer changes

Process and titer changes set different requirements for the manufacturing environment. Cell therapies and viral vectors, known to be small-scale, while mAbs are produced in increasingly small quantities as well. With single-use technologies, the change-over time between campaigns can be reduced and several drugs can be produced in a single facility.

Challenges with single-use technologies

Several years ago, extractables and leachables (E&L) of single-use technologies were a “hot” topic, but expertise and knowledge have been increasing over time. For example, the work of the BioPhorum Operations Group (BPOG) has been leading to advance the implementation of the Extractables Protocol.

Additionally, system functionality plays a major role in the discussion of pros and cons. The performance of single-use systems is not yet on the same level with stainless-steel systems especially when it comes to sensors, flow meters, and pumps, but improvements have taken place and single-use technology is advancing. One such example is the development of Fortem technology, Cytiva’s platform film.

There are two other challenges to the industry which are harder to crack: customization requirements and accurate forecasting.

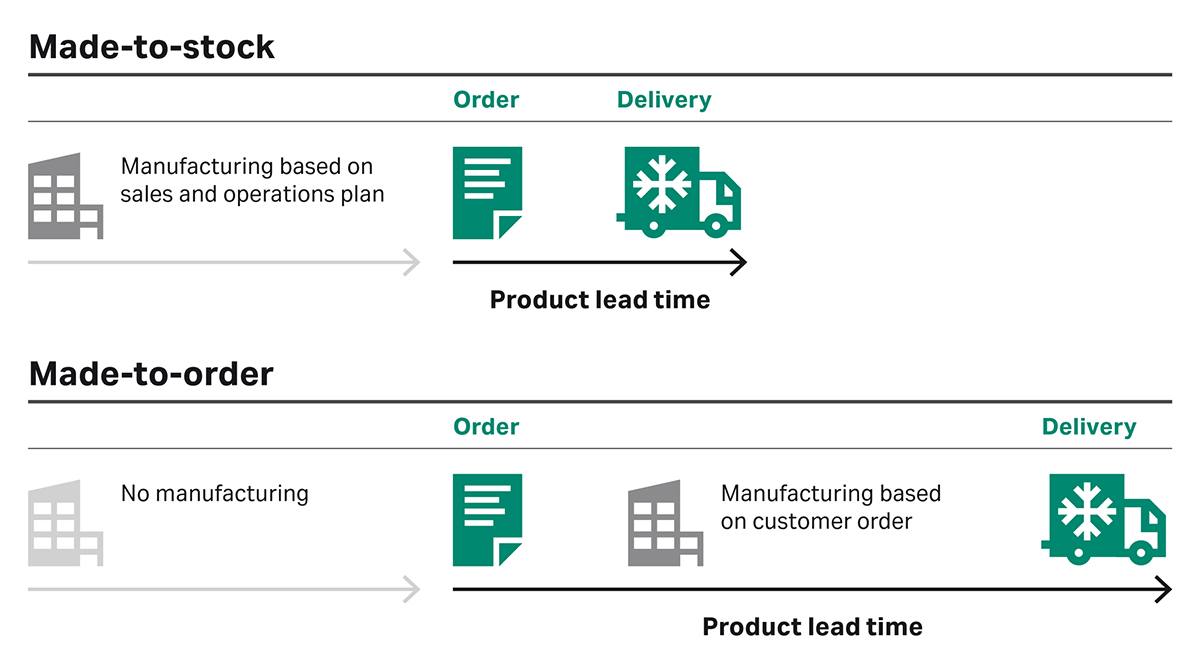

Single-use consumables are easily customized, and it can be tempting to customize an assembly to the smallest detail. The draw-back is that it becomes a unique, made-to-order item rather than a made-to-stock item. This can lead to overcomplicated consumable set-ups with hundreds of tailor-made items, making it cumbersome for the manufacturer to ensure all necessary items are at hand at the right time. Besides stretching the lead time, customization also lengthens the system’s validation processes.

Fig 3. When single-use consumables are customized, they become a made-to-order item. This stretches the lead time and lengthens the system’s validation processes.

It would be beneficial if global biopharma companies would establish more stringent review and control processes internally to limit the number of customized items, as those can have a major impact on supply. Currently, the alignment and collaboration between different manufacturing sites and countries can be weak. Especially larger companies can request hundreds of new customized items every year and this becomes unsustainable long-term.

Importance of dialogue and forecasting

The employment of single-use technologies requires changes in the relationships between biopharma companies and their suppliers, such as Cytiva, as closer partnerships and alignment are required compared to fixed systems. This has become more evident during this year, as the already somewhat constrained supply situation accelerated due to the additional demand and strains caused by COVID-19.

The management and tracking of raw materials and stock is essential, and the demand forecasts must be planned thoroughly and communicated transparently. Cytiva carries out monthly sales and forecast planning activities, in addition to quarterly and annual business review forecasting out five to ten years. During this year Cytiva has even established temporary weekly forecasts and prioritization cycles due to COVID-19.

Cytiva has broadened the scope of sales opportunities, which means that we have started communicating our sales opportunities to the manufacturing facilities earlier. This way we are reducing the risk of parts not being available for a build on time.

Way forward

It is evident that increased standardization and more accurate forecasting are not enough to tackle the single-use supply constraints. Straightforward investments are also needed.

Cytiva has recently announced its plan to invest over 2 billion USD, together with Danaher sister company Pall Corporation, to raise manufacturing capacity. As well as very significant facility expansion there will be 2000 new hires for new manufacturing lines, new facilities, around the clock shifts, and increased automation.

Fig 4. Cytiva is setting up new production sites and lines for flow kits used with the company’s single-use chromatography and filtration systems. In the picture, a new cleanroom under construction in Logan, Utah.

This strategy includes a multi-site manufacturing set-up for most of the products in Cytiva’s single-use portfolio, transfers to other Cytiva sites, and collaboration with contract manufacturers.

One example is the single-use flow kits for Cytiva’s single-use chromatography and filtration systems are currently manufactured in Westborough, MA. The target is to now have several new production lines and sites for these products in the next few months in Westborough, MA, Logan, UT, and in Eysins, Switzerland. Cytiva customers receiving products from these locations need to validate the site(s) and, in some cases, even the raw materials. This is naturally included in the collaboration.

It is important to keep in mind that these investments do not eliminate the fact that suppliers and biopharma companies need to communicate more transparently, providing the required information to one another. After all, a successful collaboration ensures that the biopharmaceutical companies will be able to deliver their therapies to patients more efficiently.

Read more

- Article: Securing today’s biomanufacturing supply chain using transformative supply

- Article: The evolution of supply chain security – increasing our focus on raw material variability

- Article: Business continuity management

- Article: Security of supply and Cell & Gene Therapy

- Security of supply at Cytiva

References

(1) BioPlan: Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 2020.

(2) BioPlan: Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 2019.

(3) Scale-up and process economy calculations of a dAb purification process using ready-to-use products