As the COVID-19 pandemic swept the world in 2020, the biopharmaceutical industry was working tirelessly to develop a vaccine. Emerging from this effort were vaccines by Moderna and Pfizer-BioNTech using messenger RNA, or mRNA. Originally investigated for cancer vaccines, mRNA had a slow uptake in the industry due to challenges with distribution specificity and stability in the body. These limitations left mRNA vaccines languishing on the back burner for decades.

Now, of course, mRNA vaccines have catapulted into the spotlight as a disruptive technology that could change the future of medicine. The scientific community still faces hurdles to efficient and effective process development of mRNA vaccines and therapies. Realizing mRNA’s potential in patient care requires focus on key areas and strategies to help alleviate bottlenecks and in this growing market segment.

Growing interest in mRNA capabilities

Although many people did not know about mRNA until the COVID-19 pandemic, researchers have studied the capabilities of RNA-based vaccines and therapeutics for almost 30 years. The potential of mRNA was reported by Hungarian scientist Katalin Karikó in the 1990s (1); yet, advancing it beyond an idea proved difficult, due to the body’s immune response to synthetic RNA. Karikó, along with immunologist Drew Weissman, eventually overcame this hurdle by incorporating modified nucleosides into mRNA, laying the foundation for its use in vaccines developed for COVID-19 (1).

The Moderna and Pfizer-BioNTech vaccines are just the beginning of a new era in the biopharmaceutical industry. In 2019 ― just before the COVID-19 outbreak ― the mRNA vaccines and therapeutics market was valued at almost USD 600 million (2). Now, this number is projected to be as high as USD 2,911.9 million by 2026 (2), and 155 therapies based on mRNA are already in today’s clinical pipeline (3).

Three parameters drive interest in mRNA:

- Safety: Unlike many conventional vaccines, mRNA vaccines do not involve infectious elements. mRNA is also degraded rapidly after injection by normal cellular processes.

- Speed: mRNA production is cell-free and faster than production of other biological drugs. mRNA can be readily standardized and scaled up, improving responsiveness to large emerging outbreaks.

- Efficacy: mRNA induces expression of specific antigens that give rise to both humoral (antibodies) and cell-mediated (T cells) immunity, which results in efficient and effective immune response.

Dr. Jing Zhu, associate director of mRNA development at GeneLeap Biotech, says the success of the Moderna and Pfizer-BioNTech vaccines drove significant changes in his company’s plans for the future. “Last year, GeneLeap Biotech had three areas of focus when it came to developing the vaccines and therapies in our pipeline: AAV [adeno-associated virus], oligonucleotides, and mRNA,” he explains. “But because of the success with the COVID-19 vaccines, we strategically shifted our main efforts to mRNA. Not only does it have the power to do things traditional modalities do not, but the development timelines and investment needed for mRNA are much less than other biologics.”

The impact of mRNA’s success in 2020 was also felt at the Centre for Process Innovation (CPI), a part of the UK High Value Manufacturing network, which aims to provide process development support and manufacturing expertise to the biopharma industry. In 2020, CPI was a key part of the UK government’s support for rapid vaccine development against COVID-19. As such, it led the work stream to develop scalable manufacturing solutions for Imperial College London’s vaccine candidate based on self-amplifying RNA (saRNA, a type of mRNA) and was awarded GBP 5 million early in 2021 to support the development of a COVID-19 variant mRNA vaccine library in the UK (4,5).

“Prior to the pandemic, CPI was studying lipid nanoparticles and also working with other companies and organizations to develop cell-free expression platforms, which prepositioned us for what we’re doing now,” says Dr. John Liddell, chief technologist at CPI. “The attraction of mRNA as a vaccine is that it’s highly potent, and you can generate a lot of vaccine product from small volumes without requiring a large manufacturing footprint. It also offers a high transcription yield and reaction through enzymatic synthesis, allowing you to achieve four or five grams per liter within a few hours. These advantages mean that a company with access to the necessary capabilities and raw materials to produce a new mRNA vaccine could do so in a matter of weeks, while other approaches will take significantly longer.”

Overall, the characteristics of mRNA make it well suited for rapid response to infectious disease as well as for precision (i.e., personalized) medicine — a growing focus the biopharma landscape ― but only if the industry can overcome current mRNA process development challenges.

Where do we go from here?

The implications of mRNA for modern medicine are far reaching, but advancing its capabilities means establishing a new development toolbox rather than relying on legacy methods designed for monoclonal antibodies (mAbs) or other gene therapies. “Compared to protein products, RNA is far more sensitive to degradation — by several orders of magnitude. It is very prone to RNase [ribonuclease] degradation,” explains Dr. Liddell. “RNase activity is ubiquitous and will destroy all of your products before you even know they’ve been destroyed. Therefore, we have to eliminate RNase activity during development and manufacture of mRNA-based products, which is very different from working with proteins. mRNA has the making of a platformable process, similar to what we have at the moment with mAbs. In [the case of mAbs], this has arisen from the advantage of having 20+ years of knowledge accumulated in that space, whereas with mRNA, there is still much to learn.”

Many of the challenges associated with the development and manufacture of mRNA are reminiscent of the early days of mAbs, when the industry struggled to overcome low titers and poor purification yields, leading to costly and inefficient commercial manufacturing. After focused effort to overcome those production challenges, mAbs became the fastest growing class of biopharmaceutical products (6). Consistency in process development is likely to be a critical factor in driving mRNA forward. “The processes used for mRNA today have all been created by independent developers, each of which applied their own skills and knowledge,” says Dr. Liddell. “It should be that the same methods used to make a COVID vaccine are the same ones used for an influenza vaccine, which thus requires standardization across a range of areas.” One of the main challenges in mRNA process development and scale-up is the lack of dedicated equipment and consumables fit for the relatively small volumes and large size of mRNA compared to recombinant proteins. There is also a lack of experience and knowledge of scaling up mRNA processes as well as an associated perception of regulatory uncertainties.

A closer look at mRNA process development challenges

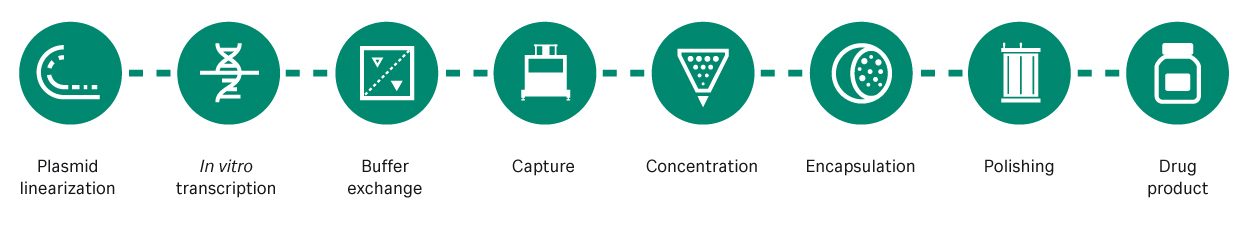

A more detailed examination of mRNA process development (Fig 1) uncovers several areas for improvement.

Fig 1. mRNA manufacturing steps. mRNA is transcribed from a linearized plasmid DNA template, captured, concentrated, encapsulated in lipid nanoparticles, purified, and finally packaged as a drug product.

Plasmid supply

An integral raw material for mRNA-based therapies and vaccines is plasmid DNA (pDNA), which acts as a template for the mRNA. pDNA is also in demand for the production of viral vector–based therapies ― another growing area of biopharma — which has led to a significant strain on supplies of GMP-quality pDNA. CPI has secured long-standing agreements with companies that make pDNA, but emerging companies such as GeneLeap Biotech struggle to get the materials they need in an increasingly competitive environment. Dr. Liddell highlights a possible solution: “For DNA template production, there are a number of alternative cell-free technologies to generating pDNA, such as rolling-circle DNA amplification approaches, which seem very promising for reducing process timelines and improving product quality,” he says. “There has been a lot of pressure on plasmid manufacture, particularly to GMP, to support gene therapy and mRNA applications. Hence with these supply chain issues alternative approaches such as rolling circle amplification may see their use accelerated.”

In vitro transcription

pDNA is manufactured in an E. coli–based fermentation process then harvested, purified, linearized, and then purified again. The resulting linear pDNA serves as the template for enzymatic in vitro transcription (IVT), yielding the desired mRNA molecule.

IVT is currently the cost-driving step in mRNA process development. “IVT is what generates the product, but it is a highly complex step. It requires the careful addition of a number of diverse components in addition to the DNA template, such as enzymes and nucleotides to synthesize the mRNA,” says Dr. Liddell. “You also need a capping reagent that will be added to the 5' end of the mRNA. Design-of-experiments approaches are typically used for process optimization of these different components to optimize yield and quality. Currently, reactions are batch based, but alternate reactor designs could be devised to reduce inventory of expensive raw materials, eventually even moving to a continuous reaction scheme. This may be harder to develop, but it could make a big difference in overall productivity.”

Dr. Zhu says the need for additional optimization has led to issues and costs in GeneLeap Biotech’s work with mRNA. “We have found that each vendor’s T7 RNA polymerase has a different ‘flavor,’ which means we will optimize one IVT system using the T7 from one vendor but then have to optimize again if we switch to a different one. That is why sustainable supply from a reliable vendor is critical for us.”

Equipment fit for the unique characteristics of mRNA is also essential. “For the upstream, we need equipment that is designed for cell-free expression platforms,” adds Dr. Zhu. “We can use some of the functionality on the bioreactors available now, but they are missing some important functions we need, like certain inline monitoring, which will help with scale-up by monitoring the different parameters that vary with mRNA models.”

Purification challenges

Another complication is the impurity profile of mRNA molecules, which can vary with each project, requiring different purification steps from case to case. “mRNA is a very large molecule ― 30 to 50 nanometers ― which is way beyond the size of proteins and comparable to viral vectors. That means they do not interact well with conventional chromatography resins, where you will likely get only surface adsorption,” explains Dr. Liddell.

The varying impurity profiles of mRNA from the IVT step calls on options in purification technologies that would allow process development scientists to mix and match media based on the specific characteristics of the molecule. Dr. Zhu points to an internal case in which GeneLeap Biotech used an oligo dT-based purification platform for mRNA. “For some of our projects, the mRNA we worked on was very clean, with a purity profile higher than 90% after the IVT. Therefore, we applied TFF [tangential flow filtration] or SEC [size exclusion chromatography] to remove the small amount of remaining impurities,” he explains. “For other projects, the impurity profile was more complex, and finding a common purification platform has been more difficult than we anticipated. Oligo dT-mediated purification often works fine. For some mRNA variants, though, we found very strong double-stranded RNA product impurities, which required a specific polishing step to separate. That is why a mix-and-match approach based on the impurity profile would be ideal to form the final process. More adapted purification solutions for mRNA, such as Cytiva’s fiber-based Fibro chromatography, could also offer a potential alternative to help facilitate purification of mRNA in the future.”

Additional considerations are based on whether the mRNA is conventional or self-amplifying, with the latter being larger, requiring additional challenges in the purification step (7). “mRNA can be made using the four conventional nucleotides as well as modified mRNA, where you are using base analogs to increase the half-life, which typically means swapping out uridine for pseudo-uridine,” says Dr. Liddell. “For self-amplifying mRNA, you are using sequences derived from certain viruses to generate what is called a replicon, constructed from four nonstructural proteins coded by the saRNA, which then makes copies of the transgene protein that the RNA is coding for. It’s quite cunning technology but is at an earlier stage of development”.

Encapsulation

Another critical step in mRNA processing is encapsulation using lipid nanoparticles (LNPs), which protect the nucleic acid from degradation as the drug makes its way through the patient’s body. Before encapsulation, the lipids are first dissolved in ethanol or another organic solvent. Because ethanol is highly flammable, facilities must be equipped for safe use of those materials — e.g., with flame-proof equipment.

Companies without these capabilities in house may look to an outsourcing partner for encapsulation services; however, few CDMOs currently have experience in this area. There are also many patents in this area, so the intellectual property landscape is complex. Dr. Liddell says the lipids used for mRNA today were originally developed to deliver small interfering RNA (siRNA) therapies. There may be better LNP formulations or alternative delivery technologies — which could also improve storage stability, another challenge for mRNA products and next on our list of areas for improvement.

Storage stability

The sensitivity of mRNA requires an ultra-cold chain to deliver COVID-19 vaccines across the world. This could be mitigated at least in part by addressing earlier process challenges. For example, says Dr. Liddell, “the low temperature needed to stabilize mRNA comes from the rough edges arising from rapid development and deployment. We had to move very quickly for COVID, so people used what was available, but I really think there's ample scope for improvement by selecting appropriate additives and excipients to achieve storage stability at higher temperatures. In addition to alternate lipid and excipient formulations, we may be able to utilize other formulation technologies, such as lyophilization, to achieve better stability.”

mRNA beyond COVID-19

The COVID-19 pandemic has taken much from the world ― most importantly, over 4.6 million lives globally as of this writing (8) ― but the mRNA vaccine offers invaluable protection for millions more and will likely open the door to new opportunities to improve patient care. However, gaps in knowledge could slow progress, not only in development but also in regulatory approval. Dr. Liddell and Dr. Zhu agree that the main focus for mRNA is likely to remain on vaccines, such as replacing the egg-based production methods, and oncology applications, but addressing process development issues is imperative to make the possibilities of mRNA a reality. Any progress the industry makes will be possible only through collaboration, communication, and a concerted effort to realize the full promise of mRNA.

- Garde D. The story of mRNA: How a once-dismissed idea became a leading technology in the COVID vaccine race. StatNews. 10 Nov 2020. https://www.statnews.com/2020/11/10/the-story-of-mrna-how-a-once-dismissed-idea-became-a-leading-technology-in-the-covid-vaccine-race/

- Brandessence Market Research and Consulting Private Limited. mRNA vaccines and therapeutic market size is projected to reach USD 2911.9 million 2026, says Brandessence Market Research. PR Newswire. 5 Apr 2021. https://www.prnewswire.com/in/news-releases/mrna-vaccines-and-therapeutics-market-size-is-projected-to-reach-usd-2911-9-million-2026-says-brandessence-market-research-885706800.html

- Roots Analysis. mRNA Therapeutics and Vaccines Market, 2020-2030. https://www.rootsanalysis.com/reports/mrna-therapeutics-and-vaccines-market.html. Jan 2021.

- Centre for Process Innovation. CPI joins national taskforce to develop COVID-19 vaccine. https://www.uk-cpi.com/news/cpi-joins-national-taskforce-to-develop-covid-19-vaccine. 20 Apr 2020.

- Macdonald GJ. UK government-backed Centre for Process Innovation (CPI) scaling up Imperial’s coronavirus vaccine. Genetic Engineering & Biotechnology News. 9 June 2020. https://www.genengnews.com/topics/bioprocessing/u-k-government-backed-centre-for-process-innovation-cpi-scaling-up-imperials-coronavirus-vaccine/.

- Ecker DM, Crawford TJ, Seymour P. The therapeutic monoclonal antibody product market. BioProcess International. 30 Oct 2020. https://bioprocessintl.com/business/economics/the-market-for-therapeutic-mab-products/

- Blakney AK, Ip S, Geall AJ. An update on self-amplifying mRNA vaccine development. Vaccines (Basel). 2021;9(2):97. doi:10.3390/vaccines9020097

- World Health Organization. WHO Coronavirus (COVID-19) Dashboard. https://covid19.who.int/ Accessed 9 Sept 2021.