The biotherapeutic market is evolving, and drug companies are accelerating and advancing cutting-edge therapies to keep pace with innovation. Patients with life-threatening diseases are counting on researchers, clinicians, and the biopharmaceutical industry to realize the promise of targeted and novel treatments such as cell and gene therapies, viral vectors, exosomes, and bispecific antibodies to treat and cure disease.

The potential for life-changing solutions makes this an exciting time to be in the business of biotech, but bringing these therapies to patients in the era of biologics comes with new challenges. The changing biological science, research, and clinical landscape make navigating the healthcare market more complex.

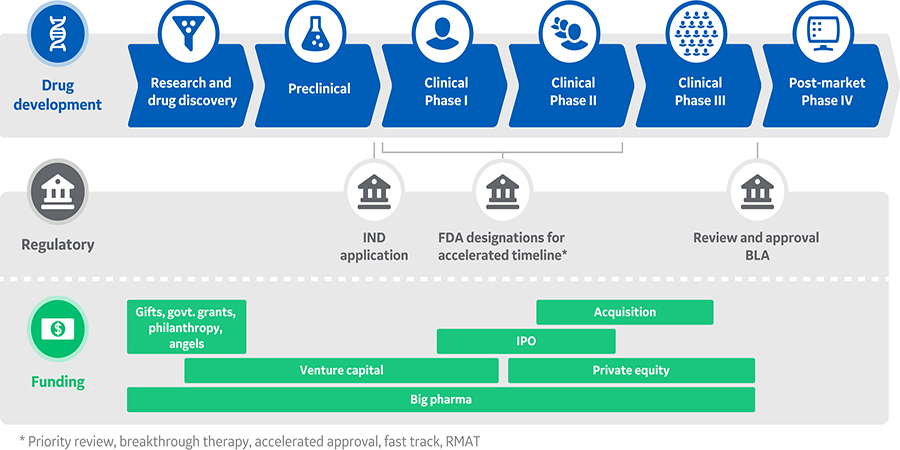

Scientific discovery and bench production set the stage for more regulated and structured efforts, including clinical trials, process scale up, manufacturing, compliance, and commercialization. Coordinating the timing of key milestones with changing financial requirements takes advanced, focused planning, as the journey to drug approval is often long and expensive (Fig 1).

With business, funding, and reimbursement concerns changing as products move through the biologics approval process, it can be difficult to maintain a focus on the overall motivation behind drug development – bettering the lives of patients.

Here, we touch on key financial considerations when bringing safe and effective therapies to the clinic. By understanding and anticipating obstacles and expectations, a newly formed biotech company can be sure it remains robust as business priorities evolve. Most importantly, dedicating efforts to forecasting funding needs early on ensures newly developed therapies are ready to help those in need without substantial delay.

Fig 1. Overview of biopharmaceutical development and production in the United States. Timelines could be substantially shorter for drugs that are the first available treatment or if the drug has advantages over existing treatments.

Funding your biotherapeutic product’s journey to patients

The development of solid science and an understanding of business economics go hand in hand when bringing a drug to market. The most safe, efficacious, and theoretically “optimal” therapy is likely to cost hundreds of millions to billions of dollars in research, development, clinical trials, and manufacturing before it is approved for use. With expenses at an all-time high, forecasting research funding needs and establishing a financial plan to drive through the various stages leading to commercialization have never been more essential for the early stage company.

Knowing how much capital is required and planning how to get it helps avoid costly delays at crucial times. So, what financing resources should be considered and when? In short, there are no set rules. We talk about basic considerations, pros and cons of commonly considered options, and how recent growth in biopharma and biotech has changed the landscape.

Build solid biological science and sound manufacturing processes to generate funds

Investment requirements in drug development vary over time. From bench-scale research to commercial manufacturing and sales, the need for capital to support purchasing, staffing, operations, clinical trials and infrastructure increases dramatically. No matter which financial sources a company pursues, the quality of the research and the potential of the therapeutic to change health outcomes or address an unmet need are essential to peak investor interest and engagement.

Non-dilutive financing can be an appealing option because existing investors and employees do not experience any reduction in company ownership or loss of equity in the business. Early stages of drug discovery are often funded by non-dilutive capital sources, including grants from federal and state agencies. Non-dilutive funds are also available from philanthropic groups and organizations working toward advancing treatments for specific conditions, such as the Alzheimer’s Drug Discovery Foundation (ADDF), The Michael J. Fox foundation for Parkinson’s disease, and many others. Applying to receive funds from these organizations is competitive and requires a solid plan for experimental design based on key scientific data, preliminary studies, supporting evidence, and measurable research objectives.

As the therapeutic asset moves into later phases of drug development, non-dilutive financing opportunities might not provide the large sums of money required. Seeking dilutive capital, in which new investors invest in the company and dilute the ownership percentage of existing investors and employees, can keep therapeutic asset development moving forward. During the period of translational research and proof-of-concept studies, investors care most about validating and de-risking the technology. To finance clinical trials and manufacturing efforts, the company will need to present data, strategy, and tactics that demonstrate a path through the reimbursement and regulatory process to drug approval and commercialization.

After raising private funds and making meaningful progress on the science of a product with valuable data, a bioetech company might consider filing for an initial public offering (IPO) to gain access to significant amounts of funds and finance growth. In addition to introducing large amounts of capital, going public can increase your global reach and brand visibility. It also offers the existing investors an exit on their investment and the company access to new sources of capital. When considering if an IPO makes sense for a business, test the waters by assessing the general IPO market for similar companies and ask key questions: Is it the right time to go public? Can your company properly achieve its key milestones? Does your company have the right support in place, including the finance team?

If a company decides to go public, proving the viability of the technology process and bringing your product goals to fruition in a timely manner will become a critical focus. A public biopharmaceutical company will be expected to execute under a public microscope for scale up. Public companies need to focus a wide range of efforts toward optimizing operations, including reducing variation and costs, building flexibility into facility infrastructure and equipment, balancing internal and outsourced talent, accurately forecasting needs, implementing plans for security of supply, and placing controls for intellectual property protection.

Establishing a strategic partnership, perhaps with big pharma, is another option for financing research, growth, and advancement. Strategic big pharma investors, are often ken to learn about new technologies as a means of outsourcing R&D and tapping into innovations early. Companies with a similar product line or clinical interest might consider investing in your drug as a separate entity. On a bigger scale, once the technology is proven, the strategic investor could also consider an acquisition or merger. The downsides to this avenue include the possibility for employment changes, cultural misalignment, and loss of autonomy. From an economic perspective, mergers also reduce competition in the market space.

Leverage the current enthusiasm for drug funding and biotech

Biologics and targeted therapies have revitalized the life sciences arena from academic research to big pharma. The promise to cure diseases that were previously without treatment and address inherited genetic disorders has brought renewed vigor to biotech investing.

Investors have been willing to take the big risks that come with biotherapeutics, but they are discerning and set key milestones to track progress and de-risk their investments. Having a product that addresses an unmet need is an obvious win. Some of the more complex concerns from an investor’s perspective might focus on clinician support, insurance reimbursement, market competition, and the qualifications of the team and board that are leading the charge.

In addition to investor excitement, the Jumpstart Our Business Startups (JOBS) Act passed by the US government in 2012 has made it easier for small startups to trade publicly, as well as permitting unaccredited investors to invest in private companies. Designed to boost funding for emerging growth companies, this legislation included provisions such as a reduced number of required audited financial statements and a confidentiality period during which companies filing for an IPO can withhold sensitive information from the public.

Keep the end goal at the forefront

A discussion of funding challenges just begins to scratch the surface of the extensive activities involved in getting a new biotherapeutic into the clinic. The effort, cost, time, and brain power that go into bringing a drug to market cannot be underestimated.

When your efforts represent a patient community’s only hope for health or survival, the journey becomes very personal. Remembering why you do what you do while navigating an often grueling path makes taking on the challenge worth it. Whether working to cure a rare disease affecting tens or a condition afflicting thousands, companies are leaning on the passion to help patients as a driving force to improve operations and achieve success.1

The clinical community is counting on all biotech and biopharmaceutical industry players to collaborate, leverage expertise, act smarter, and push further to drive medical advancements and realize the ground-breaking clinical potential that recent scientific discoveries have brought to light. Together, we can succeed both in business of biotech and in helping patients fight rare, terminal, and debilitating diseases as quickly and efficiently as possible.

Download the Business of Biotech podcast series to hear from guests who turned biotherapy ideas into clinical realities.

References

1. Scaling up bioprocess through a CDMO. Accessed January 23, 2020.